To borrow a phrase from Pogo, “We have met

the enemy and he is us.” Those of us practicing

analytics must change the ways we do our job.

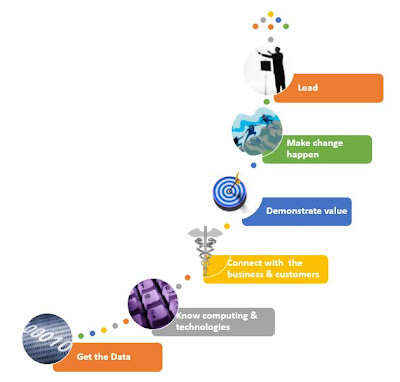

Quite frankly, there are huge opportunities to improve healthcare and many

analytics solutions to support it, but we

are only scratching the surface of our potential. We need to expand the scope of our work

from doing things with data to using data to change the organization for the

better, as depicted below.

But this is an overwhelming list of

functions and competencies. No one

person can do it all. It requires a

village (team) to have all the skills and accomplish all the functions. Some suggest that a new chief is needed to

lead us.

Salvation

from the CAO

CAO stands for Chief Analytics

Officer. (It also stands for Chief

Administrative Officer.) The role is

new for the C-suite. Michael Bloomberg,

the data-driven mayor of New York City, in his last State of the City Address,

appointed the city’s first ever CAO, Michael Flowers, to “improve the way all

agencies share information and to make the data available to the public so that

the community can hold the city accountable.”

Flowers used to be the city’s Analytics Director. It’s not clear why there was a title change. The job description sounds better in the

previous job. “Mr. Flowers leads a team

of data scientists in analyzing city data from over 20 city agencies to

allocate its resources quickly and efficiently to prevent fire, crime, safety

hazards, and unhealthy conditions.”

Chiefs are becoming very popular. Forbes lists new C-suite titles including Chief Internet Evangelist, Chief Happiness Officer, Chief Privacy

Officer, Chief Digital Officer, Chief Knowledge Officer and Chief Customer

Officer among others. In healthcare, the

new CAO role joins forces with other information leaders including the CIO

(information), CDO (data), CIO (innovation), CMIO (medical informatics), and

CNIO (nursing informatics). I bet there

are more to come.

I guess the reason for chiefs is to

bring visibility to the function, get the ear of the CEO, collaborate with peer

chiefs for the good of the enterprise, provide better management oversight, and

be accountable for results. All good

things and it’s important that analytics is recognized as an important function

along with the dozens of others. And it

is good to have the executive talent.

But, leadership is not just for the few chiefs. It’s for all of us.

Remake

ourselves

Mahatma Ghandi said “Be the change that

you wish to see in the world.” We need

to expand our technical and people skills to increase the utility of analytics

in healthcare. We need to work locally

and make teams work better through communications and collaboration and

dedication to a common goal. We need to focus

on the immediate tasks at hand such as working through an algorithm or building

a database and also be sure there is a receptor site to absorb our work. We need to visualize how analytics improves

business and society. We need to lead

by our own example.

This blog is an abstract from my

chapter, Health Analytics: The Way Forward in the forthcoming book I

am editing, Analytics in Healthcare and the Life Sciences: Strategies,Implementation Methods, and Best Practices, to be published in December 2013.